The Cost of Doing Nothing

- Idle cash losing ground to inflation

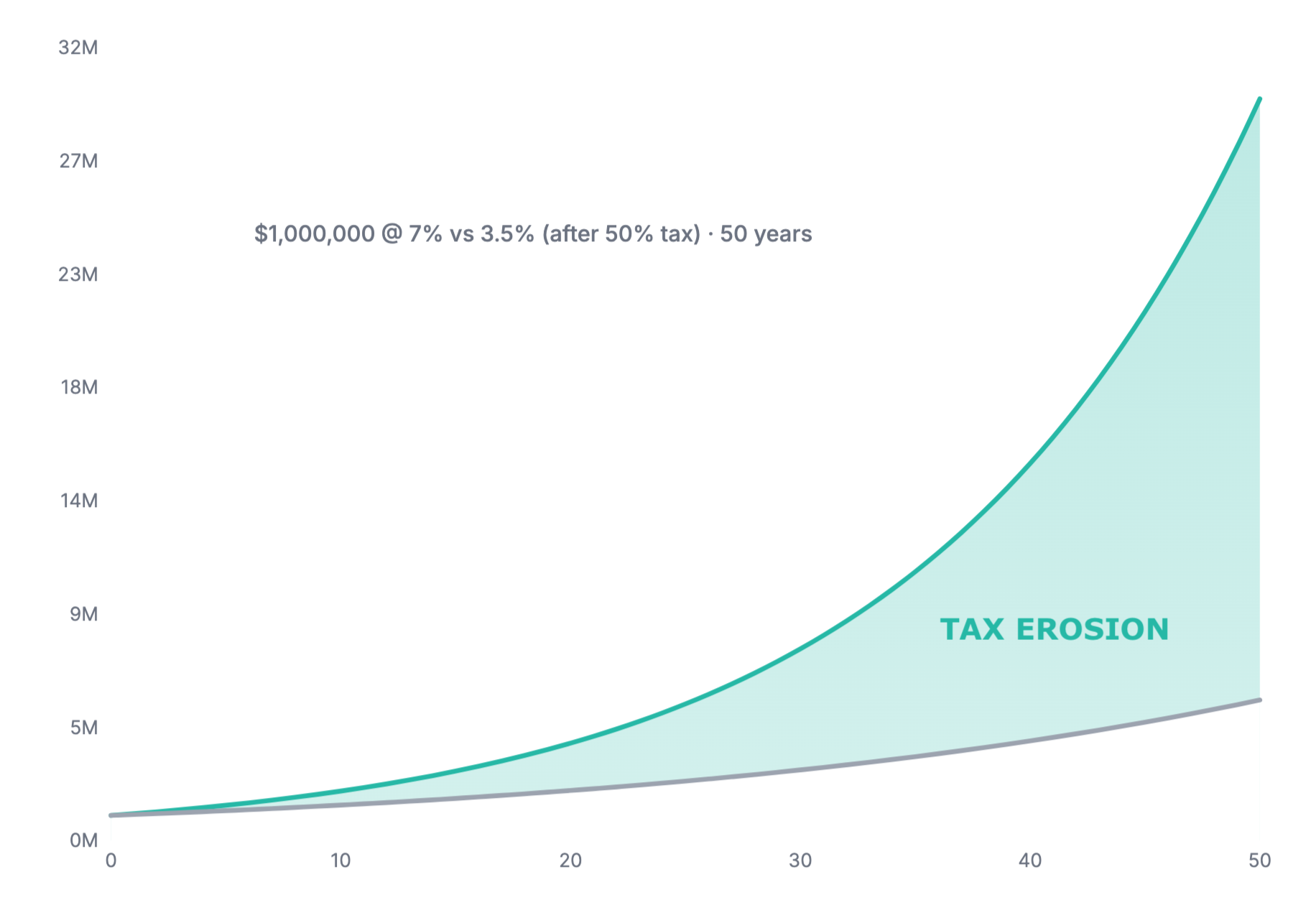

- Interest income taxed at the top rate

- No Holdco/Trust structure

- No estate or withdrawal plan

💡 These gaps can cost you and the next generation millions.

Switch to Dynasty Planning

- Put every corporate dollar to work

- Use structures that reduce lifetime tax

- Build liquidity for estate & succession

- Align wealth with family legacy

👉 The choice isn't between risk and safety: it's between erosion and compounding.

Our 3-Step Approach to Generational Outcomes

Optimize for tax

Design around efficient income types and deferral to reduce drag and boost compounding.

Invest with leaders

Brand-agnostic research to identify managers with durable edge and process discipline.

Structure to last

Align accounts, entities, and insurance to support succession and multi-gen continuity.

Our Investment Discipline

Dynasty-First Mindset

We build portfolios designed for decades, focusing on multi-generational wealth transfer, not short-term market noise.

Tax-Efficiency is Paramount

We prioritize after-tax returns by leveraging structures like the CDA, RDTOH, and corporate-class funds to maximize what you keep.

Independent & Unbiased

We are brand-agnostic, researching the entire market to identify best-in-class solutions for your unique corporate structure.

Who This Is For

This approach works best for incorporated business owners who think in decades, not quarters, and value structure over speculation.

Ideal Fit

- Think in decades, not quarters

- Value structure and discipline

- Care about the example set for the next generation

- Want an independent, thoughtful partner

- Already have capable professionals (CPA, lawyer)

- Willing to invest time in understanding

Not a Good Fit

- Want fast answers and quick fixes

- Prefer short-term optimization

- Want transactional advice

- Don't want to understand the strategy

- Are looking for guarantees or promises

- Want to replace your CPA or lawyer

That clarity is intentional. Better to identify a mismatch early than waste time on both sides.

Services for Incorporated Owners

Corporate Cash & Investments

Keep reserves liquid yet working; design growth portfolios optimized for corporate tax.

Learn about corporate accounts →Life Insurance for Business Owners

Protect key people, fund buy–sell, build tax-sheltered value, plan estate liquidity.

Explore our insurance process →Personal Insurance & Investments

Align personal RRSP, TFSA, FHSA, RESP, RDSP with corporate planning for the family.

All services →How We've Helped Business Owners

Real examples of how we've helped incorporated business owners improve structure, coordinate with their professional team, and build wealth for the long term.

Resources & Learning

For CPAs

Client-facing resources that explain investment structure concepts related to tax topics you regularly discuss. Support your tax advice with investment guidance.

View CPA resources →Insurance Guides

Comprehensive guides on corporate life insurance, buy-sell agreements, key person insurance, and estate planning with insurance for business owners.

Browse insurance articles →Resources & Tools

Downloadable guides, checklists, calculators, and templates to help you understand corporate investing and work with your professional team.

View resources →A Message from Your Advisor

Anton Ivanov

"Your corporation is your life's work. My mission is to provide the discipline and tax-smart framework needed to protect and grow that wealth for generations. We're not just investing for the next quarter; we're building a dynasty."

"As an independent advisor for incorporated professionals and their families, I've spent my career focused on the unique challenges you face: from managing passive income rules to structuring a tax-efficient estate strategy. Let's build a framework that endures."

How We WorkFrequently Asked Questions

Is corporate investing the same as personal?

No. Corporate accounts face different tax treatment. Prioritizing efficient income types and deferral often matters more than chasing headline yields.

Do you work only with one bank or insurer?

No. We're independent and brand-agnostic. We compare across providers and recommend what best fits your objectives and constraints.

Can you coordinate with my accountant and lawyer?

Yes. We regularly collaborate to align HoldCo/OpCo, trusts, estate freezes, and insurance design with your tax and legal plan.

Is this investment advice?

This website is educational. Advice requires a formal engagement, KYC/KYP, and suitability assessment based on your circumstances.