The Cost of Doing Nothing

- Idle cash losing ground to inflation

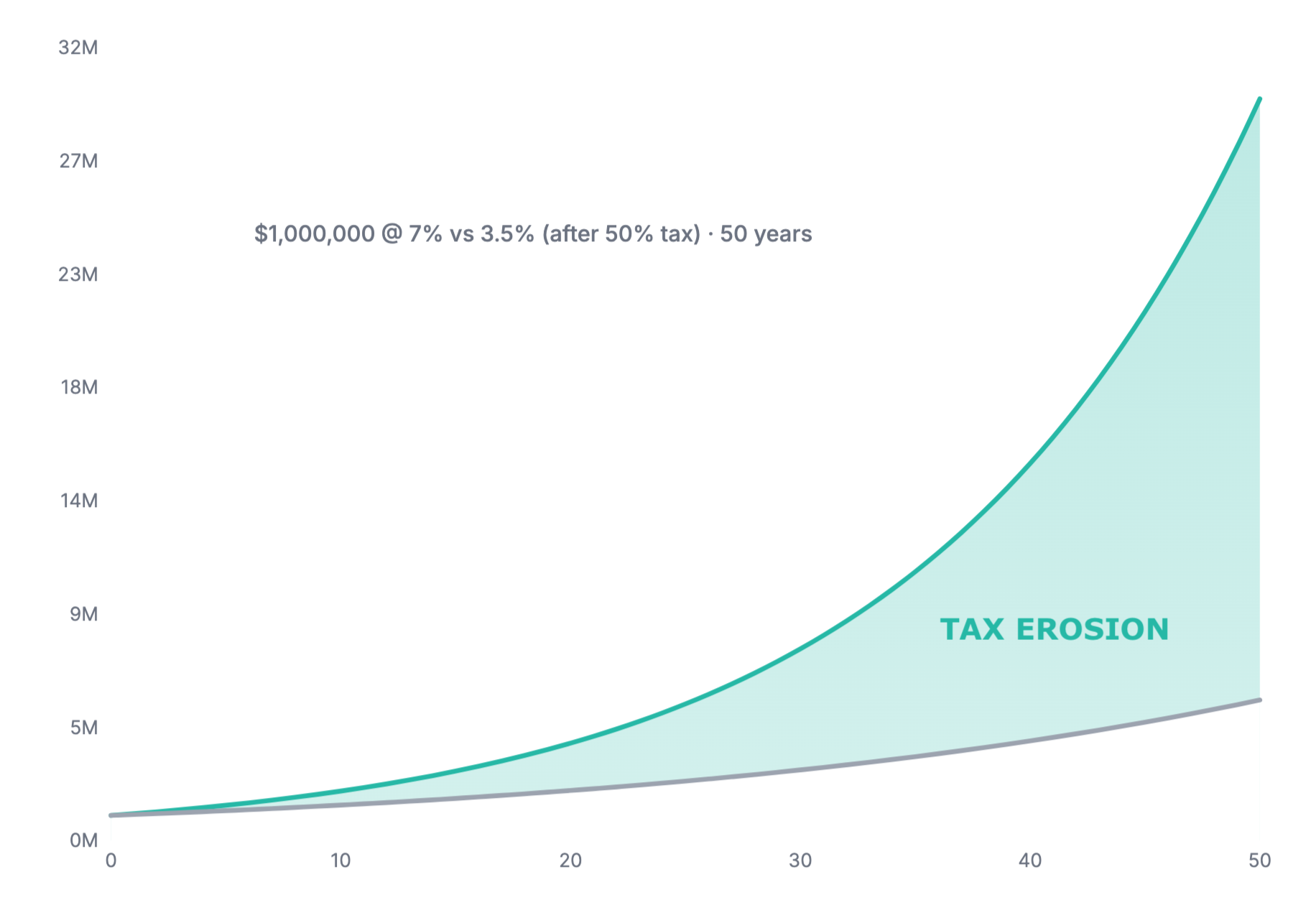

- Interest income taxed at the top rate

- No Holdco/Trust structure

- No estate or withdrawal plan

💡 These gaps can cost you — and the next generation — millions.

Switch to Dynasty Planning

- Put every corporate dollar to work

- Use structures that reduce lifetime tax

- Build liquidity for estate & succession

- Align wealth with family legacy

👉 The choice isn’t between risk and safety — it’s between erosion and compounding.

Our 3-Step Approach to Generational Outcomes

Optimize for tax

Design around efficient income types and deferral to reduce drag and boost compounding.

Invest with leaders

Brand-agnostic research to identify managers with durable edge and process discipline.

Structure to last

Align accounts, entities, and insurance to support succession and multi-gen continuity.

Our Investment Discipline

Dynasty-First Mindset

We build portfolios designed for decades, focusing on multi-generational wealth transfer, not short-term market noise.

Tax-Efficiency is Paramount

We prioritize after-tax returns by leveraging structures like the CDA, RDTOH, and corporate-class funds to maximize what you keep.

Independent & Unbiased

We are brand-agnostic, researching the entire market to identify best-in-class solutions for your unique corporate structure.

Services for Incorporated Owners

Corporate Cash & Investments

Keep reserves liquid yet working; design growth portfolios optimized for corporate tax.

Learn about corporate accounts →Life Insurance for Business Owners

Protect key people, fund buy–sell, build tax-sheltered value, plan estate liquidity.

Explore our insurance process →Personal Insurance & Investments

Align personal RRSP, TFSA, FHSA, RESP, RDSP with corporate planning for the family.

All services →A Message from Your Advisor

Anton Ivanov

"Your corporation is your life's work. My mission is to provide the discipline and tax-smart framework needed to protect and grow that wealth for generations. We're not just investing for the next quarter; we're building a dynasty."

"As an independent advisor for incorporated professionals and their families, I've spent my career focused on the unique challenges you face—from managing passive income rules to structuring a tax-efficient estate strategy. Let's build a framework that endures."

More About Our ApproachFrequently Asked Questions

Is corporate investing the same as personal?

No. Corporate accounts face different tax treatment. Prioritizing efficient income types and deferral often matters more than chasing headline yields.

Do you work only with one bank or insurer?

No. We’re independent and brand-agnostic. We compare across providers and recommend what best fits your objectives and constraints.

Can you coordinate with my accountant and lawyer?

Yes. We regularly collaborate to align HoldCo/OpCo, trusts, estate freezes, and insurance design with your tax and legal plan.

Is this investment advice?

This website is educational. Advice requires a formal engagement, KYC/KYP, and suitability assessment based on your circumstances.